Medicaid Expansion: An Overview of Potential Impacts in Mississippi

Friday, November 2nd, 2012

Key Issues and Policy Considerations Related to Expanding Medicaid in Mississippi

The U.S. Supreme Court’s June 2012 decision that upheld the Affordable Care Act (ACA) struck down a portion of the law whereby the federal government could make continued Medicaid funding contingent on a state’s participation in expanding Medicaid eligibility. States now have the option of deciding whether or not to implement the expansion. The Center for Mississippi Health Policy has published an Issue Brief that provides background information on the Medicaid program and outlines key issues and policy considerations associated with the potential expansion.

KEY IssueS & Policy Considerations

Expanding Medicaid coverage to approximately 300,000 new adults would be a major undertaking for the state and have significant impacts:

- The annual cost to the state is projected to be approximately $159 million by 2025, matched by $1.2 billion in federal monies.

- Approximately 9,000 new jobs are projected to be created by new economic activity associated with the new federal funds coming into the state.

- Accounting for the new jobs contributing additional revenue to the State General Fund, the net fiscal impact to the state in 2025 is $96 million.

- Approximately 200,000 to 300,000 uninsured adults will be provided health coverage, improving their access to preventive and primary care.

- Increased demand for health care services will put pressure on the state’s health care delivery system which already faces a shortage of primary care providers. Efforts to increase the availability of health care professionals will need to accelerate.

- Because employer-sponsored insurance is generally not available to low wage workers and since premium subsidies under the Health Insurance Exchange are only offered to persons above 100 percent of the federal poverty level (FPL), individuals below 100 percent FPL have few options other than Medicaid.

- Uncompensated care under the Medicaid expansion is projected to drop 57 percent, offsetting the loss of federal DSH payments to hospitals – which is scheduled to occur whether or not a state implements the Medicaid expansion. Without the Medicaid expansion hospitals will be faced with the need to find new sources of funds to replace DSH payments in order to cover the cost of providing uncompensated care to the uninsured.

Eligibility Under the Expansion

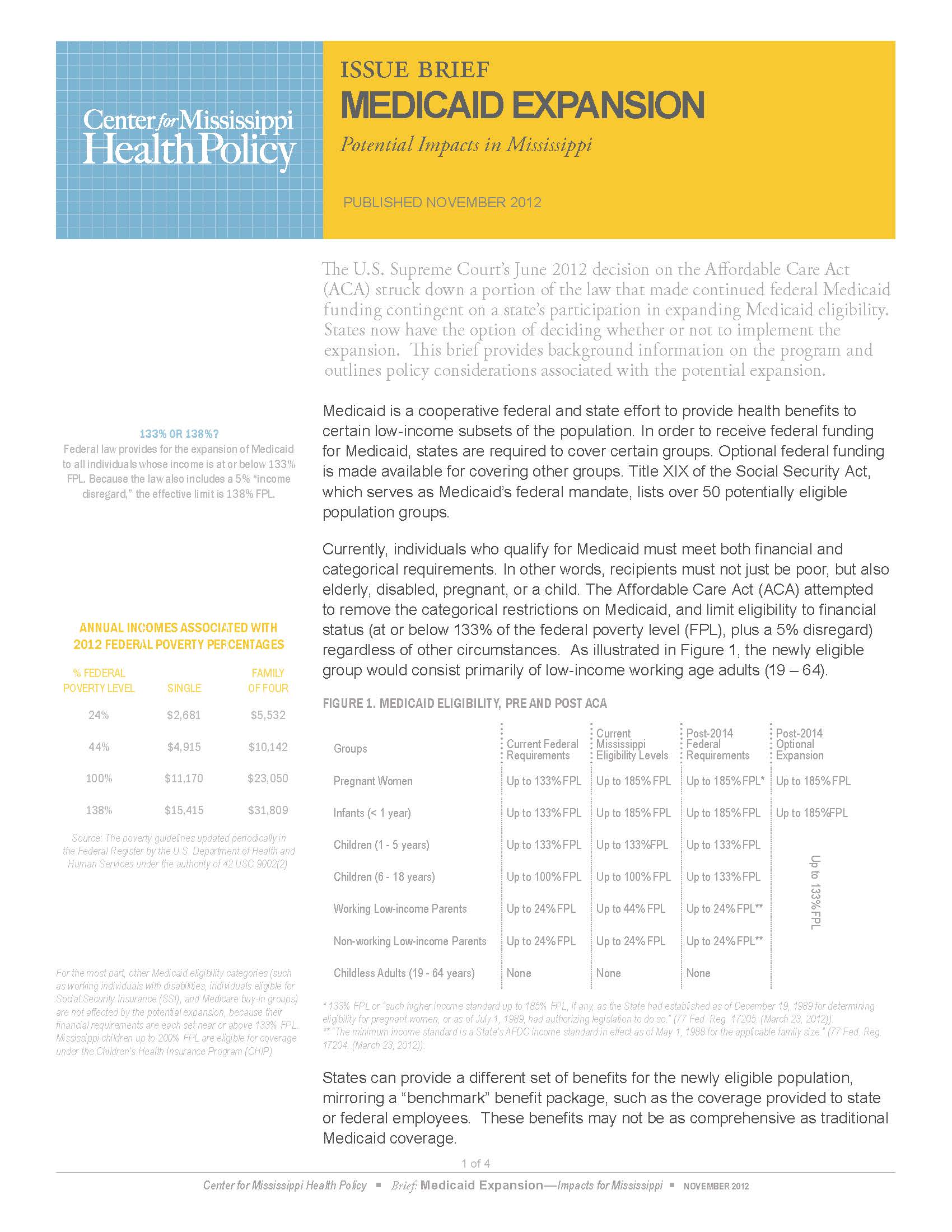

Currently, individuals who qualify for Medicaid must meet both financial and categorical requirements. In other words, a recipient must not just be poor, but also elderly, disabled, pregnant, a child, or a parent of a minor child. The Affordable Care Act (ACA) attempted to remove the categorical restrictions on Medicaid, and limit eligibility to financial status (at or below 133% of the FPL, plus a 5% income disregard) regardless of other circumstances. As a result, the newly eligible group would consist primarily of low-income working age adults (19 – 64).

Coverage Impact

Expanding Medicaid would substantially reduce the number of uninsured Mississippians. Approximately 40 percent of adults 19-64 years of age and at or below 138 percent FPL in Mississippi are uninsured. Most of these individuals are workers who are either not offered insurance by their employer, not eligible for coverage (e.g. part-time workers), or cannot afford it.

Nationally, only one-third of low wage workers in small firms are eligible for health coverage through an employer. Most private employers in Mississippi do not offer health insurance to their employees. In 2011, only 26 percent of small employers (fewer than 50 employees) in Mississippi offered health insurance.

| Occupations in MS with Most Uninsured Workers at or below 138% FPL | ||||

| Cashiers | 14,445 | Medical Aides | 4,084 | |

| Cooks | 8,731 | Laborers & Movers | 6,984 | |

| Construction Workers | 6,869 | Store Clerks | 3,915 | |

| Maids & Housekeeping | 6,021 | Retail Salespersons | 3,092 | |

| Truck & Other Drivers | 5,950 | Food Service Managers | 3,088 | |

| Waiters & Waitresses | 5,280 | Agriculture Workers | 2,993 | |

| Janitors & Cleaners | 5,178 | Assemblers & Fabricators | 2,954 | |

| Grounds Maintenance Workers | 5,067 | Childcare Workers | 2,803 | |

| Other Production Workers | 4,724 | Painters & Maintenance | 2,704 | |

| Carpenters | 4,472 | Retail Sales Supervisors | 2,552 | |

| Source: American Community Survey, U.S. Census Bureau, 2010. Data compiled by C4MHP using IPUMS-ACS. | ||||

Economic and Fiscal Impact

Researchers at the University Research Center of the Mississippi Institutions of Higher Learning (IHL) conducted an in-depth analysis of the potential effects of the Medicaid expansion in Mississippi from an economic perspective. The report, “The Fiscal and Economic Impacts of Medicaid Expansion in Mississippi, 2014-2025,” projects the costs to the state for the first twelve years of the expanded program, as well as the direct and indirect economic benefits expected to accrue to the State, including additions to State General Fund revenue.

Assuming a high participation rate, the study projects that approximately 280,000 – 310,000 persons would be enrolled under the expansion. The annual gross state Medicaid costs for expansion would range from approximately $8.5 million in 2014 to $159 million in 2025. Over the same period of time, the federal dollars flowing into the state for Medicaid Expansion would range from an estimated annual amount of $426 million in 2014 to $1.2 billion in 2025. The economic activity associated with the influx of federal dollars contributes to employment additions in the state that range from 4,178 jobs in 2014 to 8,860 jobs in 2025. The new jobs contribute additional revenue for the State General Fund which offsets some of the state costs for expansion. As a result, the state will not experience a net fiscal impact until 2017. The net fiscal impact is the gross state costs of Medicaid expansion minus additions to state general fund revenue associated expansion. The annual net fiscal impact will rise to $96 million in 2025.

Disproportionate Share Hospital (DSH) Payments

Hospitals have been receiving DSH payments to partially offset the cost of providing uncompensated care. In FY 2012, Mississippi hospitals received $156.5 million in federal DSH funds. The ACA provides for a reduction in these payments beginning in 2014.

Private Insurance Impact

The American Academy of Actuaries issued a decision brief that examined the potential impact of the Medicaid expansion on private coverage and concluded that individual market premiums and Health Insurance Exchange premiums may increase in states that opt out of the Medicaid expansion due to adverse selection. The group also noted that employers with at least 50 workers may be at greater risk of penalties because low income employees who might otherwise enroll in Medicaid could request premium subsidies thereby triggering penalties for the employer.

State Agency Impact

Several state agencies provide medical services to low income populations. Some of these costs can be funded partially with federal dollars if Medicaid eligibility is expanded. Key agencies include the Departments of Health, Mental Health, Rehabilitation Services, and Corrections, as well as the University of Mississippi Medical Center.

Changes to Medicaid Regardless of Expansion

The ACA impacts Medicaid in other ways. Whether or not a state chooses to participate in the expansion, additional changes will be required by the federal government. Some examples of these changes include the following:

- Simplification of eligibility requirements

- Streamlining enrollment processes

- Potentially increasing enrollment (“woodwork effect”)

Download the Issue Brief for more information.